Cambridgeshire County Council’s housing development company, This Land Limited, has unveiled a new business plan that it says will finally put the company on a sustainable footing — and return more than £126 million to local taxpayers by 2030.

The plan, published ahead of a shareholder sub-committee meeting on 24 July 2025, marks a critical moment for the company, which has faced years of financial strain and political scrutiny since its creation in 2016.

Councillors signed off on the detailed strategy, which outlines how the developer will complete its existing housing projects, dispose of surplus land, and repay loans owed to the county council — without requesting any further public money.

A company born out of council ambition

This Land was set up in 2016 as a bold experiment: a wholly council-owned housing company tasked with delivering high-quality, sustainable homes across Cambridgeshire. It was meant to combine two goals — tackling the county’s pressing housing shortage while generating income that could be reinvested into frontline public services.

By 2024, the council had invested nearly £120 million into the venture, primarily through loans, while also providing around £6 million in equity. In return, This Land delivered £78.8 million in capital receipts and £42.6 million in interest back to the council between 2017 and March 2024.

But progress has been slower than first promised. The pandemic, economic turbulence, and spiralling construction costs all dented cashflow and forced the company to rely on repeated extensions of council support.

Loan restructuring: a turning point

Earlier this year, councillors reached a breaking point. In January 2025, they rejected a draft business plan that sought more flexible loan terms and additional investment. Instead, they demanded a more disciplined approach that would not expose taxpayers to further risk.

By March, a new deal was struck. The council agreed to restructure This Land’s loans into two parts:

- £59.9m would remain as an interest-bearing commercial loan, repayable by 2030.

- £59.9m would be converted into a capital contribution, contingent on performance and not subject to interest.

This restructuring allowed the company to stabilise its finances, continue work on existing projects, and commit to repaying the council in full. Over the next five years, the Council is forecast to receive more than £126 million in combined loan repayments and interest — more than the original investment.

Michael Hudson, the council’s executive director of finance and resources, said the plan “secures the company’s solvency, protects the value of council assets, and ensures taxpayers see a return on their investment.”

The 2025–2030 business plan: what it says

The new five-year business plan, approved by This Land’s board on 6 June, sets out a roadmap for the company to wind down its portfolio of sites by 2030.

Key points include:

- Debt repayment: The company will repay £59.9m of loans and £21m in interest to the council by 2030, with potential for early repayments from 2027 onwards.

- No new loans: The plan is clear that This Land will operate within its existing resources, requiring no further taxpayer bailouts.

- Site disposals: All remaining land and housing projects will be sold by 2030, but with “no fire sales” — meaning sites will be sold at fair market value rather than at a discount.

- Cost control: Operating expenses will be reduced over the next year to align with the reduced scale of activity.

- Quarterly reporting: Councillors will receive regular monitoring updates to ensure the company remains on track.

Financial modelling, tested by external advisers, shows the company can remain solvent under a range of scenarios, even if house sales or land disposals are delayed.

Housing schemes in focus

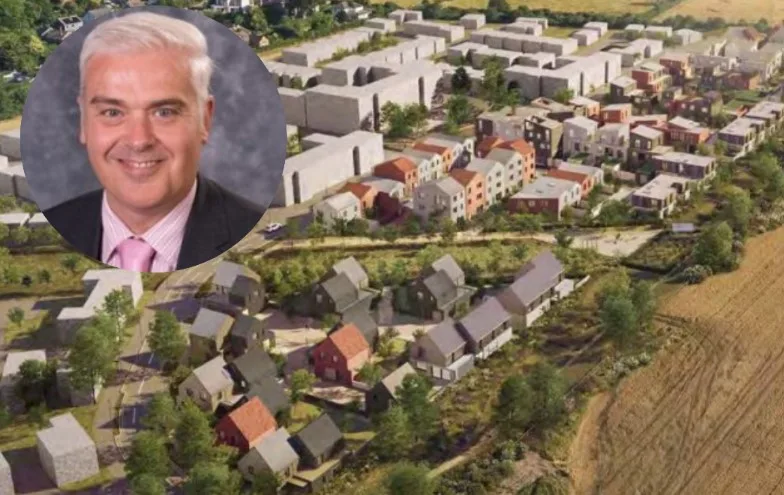

While much of the detailed site information remains commercially confidential, the plan confirms progress on several significant developments:

- Burwell: Phase three of the site will be sold to a third-party developer to deliver around 61 new homes.

- Eddeva Park (Worts Causeway, Cambridge): This Land will build 32 affordable homes as part of its wider second phase, with a housing association lined up to purchase the properties once completed.

- Landbeach and Ditton Walk: The company is seeking final approvals to complete transactions on homes already built and sold.

Future transactions are also in the pipeline, but councillors will need to give further consent before these proceed. Importantly, This Land retains flexibility to either build homes itself or sell parcels of land to other developers, depending on what delivers the best financial outcome.

A greener, fairer Cambridgeshire?

Beyond finances, the plan emphasises This Land’s role in helping deliver the council’s wider ambitions. These include supporting net-zero carbon targets, promoting sustainable design, and ensuring affordable homes are delivered within new communities.

The company says it has adopted rigorous health and safety standards and engaged the British Safety Council to review its systems. It also promises high build standards and “placemaking” that enriches local communities.

However, critics note that with no new sites currently planned, This Land’s direct impact on Cambridgeshire’s housing supply may soon diminish. Any future development opportunities would need to be agreed by councillors, likely not before 2026.

Risks on the horizon

Despite the cautious optimism, significant risks remain. The housing and construction markets are notoriously volatile, and national economic factors such as inflation, labour shortages, and interest rates could all impact delivery.

The council’s own report warns that strong governance will be essential. Quarterly monitoring will allow councillors to intervene quickly if problems arise.

There is also the political question of whether This Land has truly delivered on its original promise. While the company has repaid millions to the council, it has not built homes at the pace initially envisioned, and some argue the venture has tied up scarce council resources.

Why It matters to taxpayers

At its heart, the story of This Land is about more than just balance sheets. It is about whether councils should act as property developers — and if so, how they can balance commercial risk with public good.

For Cambridgeshire, the stakes are high. The £119.8 million invested in This Land could otherwise have been spent directly on schools, roads, or social care. Ensuring that money is returned, with interest, is now the overriding priority.

The latest plan appears to put the company on track to achieve that — but only time will tell if the numbers hold up in practice.

What happens next?

On 24 July, councillors on the shareholder sub-committee:

- Approved the business plan and noted the financial appraisal of risks.

- Agreed land transactions at Burwell, Eddeva Park, Landbeach, and Ditton Walk.

- Delegated authority to senior officers to release council restrictions on sites, enabling sales to proceed.

- Promised to scrutinise future updates on other sites likely to be brought forward over the next 12 months.

Conclusion: A company under watch

This Land’s future is not about growth, but consolidation. Its mission now is to complete the homes already promised, sell its remaining land, and repay the council’s loans.

If successful, it will not only secure the repayment of taxpayers’ money but also deliver hundreds of new homes — including affordable ones — across the county.

If it fails, the experiment of council-owned housebuilding in Cambridgeshire may be remembered less as a bold innovation and more as a costly gamble.

Either way, the coming years will be decisive. Councillors, taxpayers, and would-be homeowners will be watching closely

On 24 July, councillors on the shareholder sub-committee considered the new business plan submitted by This Land; representatives attending included Barbara Richardson (chair of This Land), Rob Williams (interim chief executive), Oliver Haunch and Sam Dean (Grant Thornton), and Becky Francis (development surveyor, council property Assets Team).

Barbara Richardson, recently appointed chair of the company, reported that the board had scrutinised and challenged the plan extensively. Their focus was on:

- strengthening governance,

- aligning company strategy with shareholder objectives,

- ensuring accountability and robust performance management, and

- improving shareholder–company relations.

Rob Williams, interim CEO (in post for three months), explained that the plan’s philosophy was low-risk, asset-focused, and delivery-driven, fulfilling loan obligations while preparing for sustainable long-term growth.

The plan pursued three objectives:

- Maximise the value of existing assets to meet council obligations.

- Improve monitoring, reporting, and governance to increase shareholder confidence.

- Provide a framework for strategic review of the company’s future direction and purpose.

The plan incorporated assessment of risks in the residential development market alongside opportunities for growth and mitigation strategies. Grant Thornton confirmed the plan’s viability and deliverability.

Financial position

The finance director confirmed:

- The council has provided £133m funding to This Land. Of this, £13m plus £300k interest has been repaid, leaving £119.8m in outstanding loans.

- Following local government reorganisation, ownership of This Land would transfer to new successor authorities.

Strategic Review

This Land acknowledged the need for an external strategic review, expected to conclude by November 2025. The council would then provide shareholder direction for consideration in February 2026.

Planning and site delivery

- Nearly all current sites already had planning consent. Two sites were pending but expected within statutory timelines; neither was critical to cash flow.

- About 20% of sites had completed deals.

- The business plan assumed no new site acquisitions, though exceptional opportunities could be referred back to the sub-committee.

- The majority of projected positive cash flow would derive from land sales rather than property sales (approx. 75%).

Financial sustainability

- The plan maintained positive cash flow without requiring additional council loans.

- Grant Thornton’s stress testing indicated the plan was robust, with contingency built in to manage timing slippage.

- Extraordinary events (e.g., another pandemic) might trigger reconsideration of funding.

- Loan repayments were factored in ahead of schedule where possible.

Organisational resilience and workforce

Following redundancies, the company team had shown resilience. Staff retention was identified as a priority, especially as the housing market improved.