With long terms loans of £113.831m and equity of £5.851 m, the £119.702m exposure of Cambridgeshire County Council through its wholly owned This Land housing company is to be examined by county councillors on Tuesday.

An updated business plan for This Land will not be made public but discussed in private by the strategy and resources committee.

However, Michael Hudson, the county council executive director of finance and resources, sets out current thinking in a separate, and public, report.

“Although there are potential service and financial benefits from well governed ventures, the committee will be aware of high-profile examples elsewhere of councils experiencing financial difficulties and requiring national intervention as a result of disproportionate commercial risk, in some cases involving subsidiary housing companies,” he says.

“There are some important distinctions in relation to CCC’s arrangements with This Land, importantly that the business plan continues to provide a detailed pathway through to the company meeting all of its financial obligations.

“And that the council’s overall exposure to commercial income is proportionate and within the limits set within our capital strategy, according with the prudential code.”

But he warns: “Nevertheless, the 2023 submission from This Land does show reduced headroom for any further downside and a relatively tight route to stay on track with financial obligations coinciding with the current economic uncertainty.

“Continuing oversight and assurance mechanisms will be exercised by the council, and we intend to commission an updated third-party economic review of the This Land profit and cashflow assumptions, and testing of the latest and revised financial model, across the summer and into early autumn.”

He explains that This Land is the council’s wholly owned property development company.

As at July 2023, the financing advanced to This Land by the county council is as follows:

Long Term Loans £113.851m Equity £ 5.851m Total £119.702m

The figures are unchanged from the submission of the previous annual business plan to the committee in September 2022.

Mr Hudson says the council is currently receiving revenue interest on the loans advanced (a £6m net contribution is expected this financial year).

Principal loans schedule

In addition to interest, the council has also already received capital receipts from This Land in excess of £75m for the sale of property at market value.

The principal loan sums are currently scheduled for repayment to the council between August 2026 and February 2029.

“As the sole owner and lender to This Land, the county council is the ultimate beneficiary of all of the company’s proceeds,” says Mr Hudson

“It is essential This Land continues to make the expected progress with delivery against its business plan in order to provide the anticipated revenue stream across the medium-term financial planning period.”

Although the council stays ‘hands off’ from day to day running of This Land, he explains that the council as lender, has a further monitoring role to gain assurance that funds on loan will be repaid.

He says key headlines from the 2023 plan, submitted by This Land, include:

- Delivering approximately 863 new homes in total (of which 490 are supplied by This Land directly, with the remainder as “master-developer”) with 78 completed to date.

- 387 of these homes will be affordable representing 45% of the portfolio.

- Ambitions to extend the commitment to affordable housing, including acquisition of further land from the council to enable this.

- Securing additional land under option to ensure the continuation of the business in to the medium and long term.

- Disposal of assets which do not meet the company’s commercial appraisal criteria (based on size and profit).

- Commitment to deliver environment, social and governance policies and to work closely with the housebuilding supply chain to reduce carbon footprint to net zero.

Key financial returns from the company to the council, set out in the central planning assumption in this business plan are:

- Repayment of £113m loans by 2029, with no further borrowing expected (at this time)

- Payment of £72m in total interest to the council (of which £41m is from 2023 onwards)

- Projected residual cash balance in 2029 of £0.7m.

In the central assumption, the sources of expected profit (before interest) are as reported by This Land:

Existing/Retained Sites £82.1m

Strategic Land £27.2m

Future CCC Land £15.9m Affordable (exception) site £0.8m

Disposal sites £ (0.8) m

Subtotal profit £125.2m

Mr Hudson says there have been revisions from the This Land business plan of 2022.

“Whereas last year the company’s central scenario planned that loans would not be fully repaid to the council until 2031 (by way of a £6m delay on the repayment of funds due in 2029) in this year’s revision all £113m has been projected as repayable by 2029,” he says.

- The total interest receivable by the council has decreased from £75m to £72m

- The number of homes planned to be delivered has decreased by 62

- Total expected profit (before interest) in the central assumption across the long-term plan has decreased by £11.5m

- The residual cash balance is £0.7m in 2029 rather than £16.3m in 2035.

“This Land reports that it maintains a good cash position, without the need for additional borrowing from the council, however the surplus of funds available to build additional homes has been reduced from last year’s business plan,” says Mr Hudson.

The key change in transactions currently in progress is that the sum receivable for the partial disposal at a site in Greater Cambridge Worts is less than planned last year.

“The rest of the adverse change is attributed to reductions in revenue expected at a site in East Cambridgeshire and increased costs expected at two other sites in East Cambridgeshire as well as additional operational expenditure costs of This Land,” he says.

To accommodate the cashflow shortfall that arises from these changes, the business plan includes revisions agreed by the company’s board to:

- Sell Ditton Walk (Cambridge) Phase 2 (originally planned to develop by This Land directly).

- Sell Burwell Phase 3A (originally planned to develop by This Land directly).

- Accelerate the land sale at Soham Eastern Gateway by 18 months and reduce the number of homes that This Land will build at Soham Eastern Gateway by 40.

In relation to financial transactions facing the council, the 2023 plan adopts a more self-sufficient approach to future funding than the 2022 submission.

“Council officers consider this is the appropriate outlook,” says Mr Hudson.

He reminds councillors that in 2020, the council agreed in principle to loan up to £180m to This Land with an operational boundary at £150m.

This Land’s 2022 business plan included a further £6m of borrowing from the council, applying a lower effective cap at £120m, whereas in 2023 This Land’s submission proceeds on the basis no further funding will be available above the amounts set out, he says.

“This is a sensible proposition to contain the council’s overall lending exposure however it entails a tighter cashflow position across the next two years in particular,” says Mr Hudson.

Downside risks

“The sensitivity analysis also shows that should downside risks materialise, for example from a sustained fall in land / house sales or prices, This Land and the council are likely to need to revisit this assumption.”

Mr Hudson says “scenario and sensitivity testing” has been submitted alongside the business plan.

This scenario adopts a neutral outlook on inflation across the long-term planning horizon for This Land.

“Simply put this is that there is no increase in revenues generated from housing or land sales and no increase in build costs,” he says.

“Upside: The upside scenario assumes a 3% increase in revenues, but all costs remain stable.

“Downside: The downside scenario assumes a 2% reduction in revenue and a 6% increase in build costs.”

Mr Hudson adds that This Land has noted that Cambridgeshire house prices are currently at record highs “and the continuing momentum in the housing market despite recent global disruptions and UK specific headwinds facing the mortgage market.

“A potential downturn is a significant risk to This Land (particularly if it is sustained over a longer period.”

Mr Hudson says the council has recently added a floating charge to the security it holds over the firm in recognition that land and building disposals are currently depleting the company’s fixed assets (and associated fixed charges thereby released), with proceeds either held as cash or redeployed into work-in-progress assets.

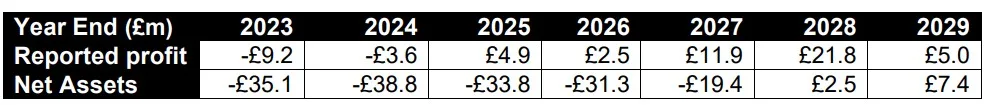

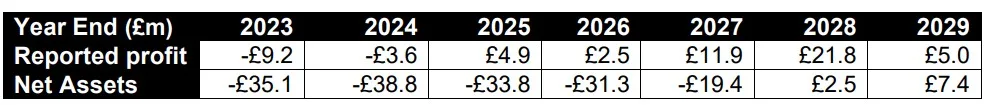

He will show a table to councillors that shows This Land currently has negative net assets for financial reporting purposes.

“And it will be apparent the value of assets that could currently be realised by the company, in the event of liquidation, remain less than the value of the loans that the council has advanced,” he says.

“The deficit position is due to peak during the 2023-24 financial year, with profits thereafter scheduled to deliver the company to its loan repayments and expected balance sheet position by 2029.

Reliance on cash flows

“This underlines that there is a reliance on cashflows from developments currently in progress to ensure the company’s financial obligations to the council can be met.

Mr Hudson will also report that This Land has requested that the county council provides a parent company guarantee in relation to a number of infrastructure works where either the utility provider or the highway authority (also CCC) requires developers to provide a deposit or a bond to guarantee the delivery of works required under a section 104, 38 or 278 agreements.

“This is designed to ensure that infrastructure works, and any remediation are completed in the event a development company ceases trading,” he said.

“Bonds allow an annual payment based on a percentage of the agreement fee whereas a deposit payment ties up the full agreement amount for the duration of the work, defect, and adoption periods.

“A bond therefore allows more working capital to be available to the company.”

Mr Hudson says that for this reason, This Land’s preference is not to provide a deposit and to follow the bond approach.

To be able to utilise a bond however, This Land needs to be backed by a parent company guarantee or deed of indemnity which would be for the county council to provide.

“There is no upfront financial cost to the council of providing this, but a contractual commitment is given that the council will either step in to complete works or reimburse the bondsman for the same, in the event that This Land were to fail,” says Mr Hudson.

“It is considered desirable for This Land to be able to enter into the bonds and that this is compatible with the risk the council is already engaged with in terms of company’s successful delivery of infrastructure construction.

“We have reviewed the company’s spending profile for infrastructure works, the parent deed underlines the council’s interest in monitoring and overseeing the conduct of This Land in delivering construction works.

“The alternative approaches of requiring This Land to make deposits would expose the council to similar or greater risk through additional lending and cash outlay.”

Mr Hudson says his report sets out the current financial assessment of return and risk to the council.

“At this stage the This Land business plan submission does not lead to a change to our CCC medium term financial plan assumptions, although we will continue to keep this under review,” he says.

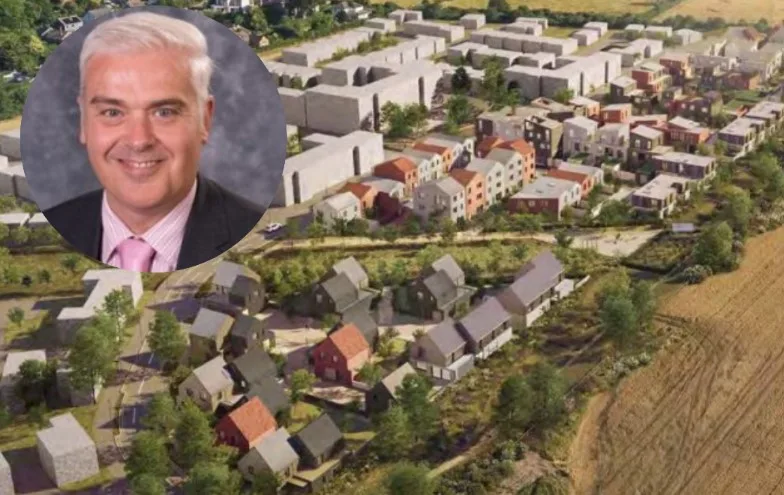

Cambridge City Council has given permission to This Land to build 80 homes to the south of Cambridge as part of the Eddeva Park development.