A measured but cautiously optimistic assessment of This Land’s fortunes – the property company wholly owned by Cambridgeshire County Council – will be presented to the subcommittee that oversees it on February 17. The report has been prepared by Michael Hudson, the council’s executive director of finance and resources.

He will invite the shareholder subcommittee to look at This Land’s performance and to consider its business plan for 2026-2030.

“This enables councillors, acting as the shareholder, to hold the company to account through early and ongoing assessment of the position relating to the council’s loan repayments and security,” he says.

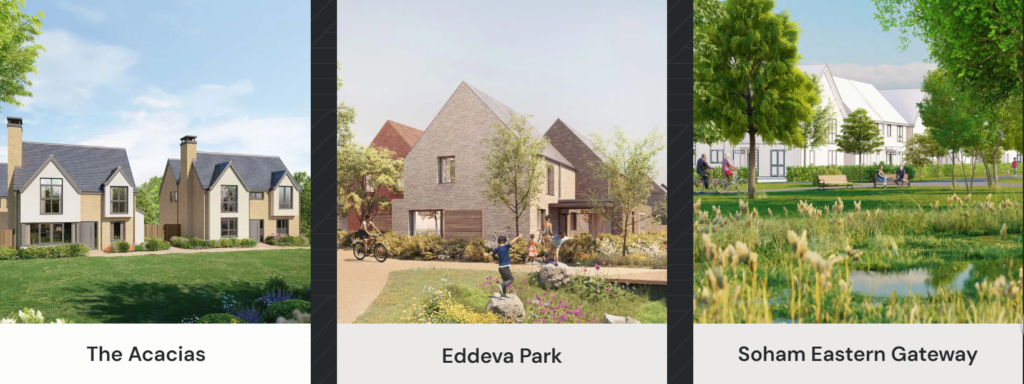

“The first three quarters of 2025/26 have seen the company progress with sales, including at key sites such as Burwell, Eddeva, and Landbeach broadly in line with the plan.

“Officers have undertaken due diligence of progress against the plan through both meetings with the company’s senior leadership and board, as well as through external advisers.

“Overall, this found that the assumptions shown within the plan for the first three quarters of 2025/26 have been met and delivered.”

Explaining that This Land’s operation loss is worse than expected, nonetheless “the intended early repayment of loans is now forecast to be within the contractual timings or slightly better but is still in 2026/27.

“This has the positive effect for the company of not incurring costs in 2025/26.

“The council had not assumed this sum in its forecasts and as such this has nil impact on the council in year, and the focus remains on the repayment on contractual terms being secure.”

This Land’s next loan repayment is scheduled for August and November 2026 “and remains on track”.

Mr Hudson adds: “However, key risks need to continue to be monitored, challenged and managed.

“The delayed point of sale recognition continues to distort profitability, and focus should be on cashflow and debt service metrics which remain positive as conversely a delay in costs and reduced early interest payment means that the closing balance remains largely unchanged from the 2025/26 annual budget.

“In fact, cashflow at £12.4 million is £1.939 million improved because of the deferred expenditure.”

The company’s strategy is set out: optimise existing land assets to generate returns, repay loans, and reinvest in local public services. With Cambridgeshire County Council’s investment standing at £119.8 million, This Land is on track to repay £59.9 million in principal and £22.3 million in interest by 2030.

Already delivering: £82m in returns

Since 2017, This Land has delivered £78.8 million in capital receipts and £42.6 million in interest revenue, supporting all seven council ambitions.

Once current developments are complete, the company expects to fully repay the £59.9 million loan, along with £22.3 million of accrued interest, leaving a small surplus of £150,000 for future projects.

2026/27 budget and 2026–2030 cashflow: positive and stable

The updated business plan emphasises “continuity, aimed at optimising the existing asset base.” External advisors have validated the plan, and Grant Thornton conducts quarterly reviews on behalf of the Council.

Projected cashflow highlights (£’000):

| Year | Opening Balance | Site Cashflows | Operating Costs | Interest Paid | Capital Repayment | Closing Balance |

| 2025/26 | 10,959 | 8,184 | -3,201 | -2,000 | -1,900 | 12,427 |

| 2026/27 | 12,427 | 14,038 | -3,300 | -5,134 | -7,500 | 10,564 |

| 2027/28 | 10,564 | 34,852 | -2,475 | -2,646 | -36,846 | 3,596 |

| 2028/29 | 3,596 | 20,179 | -1,238 | -463 | -13,655 | 8,044 |

| 2029/30 | 8,044 | 4,576 | 0 | -12,050 | 0 | 150 |

The plan forecasts £80 million positive cashflow across operational sites and projects. Surplus funds, after overheads, are directed toward loan repayment and interest reduction.

Loan strategy: smart prepayments to reduce costs

This Land plans to prepay some loans ahead of schedule, cutting interest costs. Interest rates start at 9.37%, dropping to 7.5% from April 2027.

If all loans were charged at 7.5%, the total interest over five years would be £2 million lower, raising closing cash to £2.15 million—a boost for working capital and strategic flexibility.

Despite slight profit delays, property firm’s cashflow strong and loan repayments on schedule through 2030 IMAGE: This Land Ltd

Operational forecast: site-by-site performance

Net cashflow forecasts by development type:

- Master developer Sites: £11.6 million

- Development property transactions: £44.9 million

- Strategic land sites: £7.3 million

- Promotion fee receipts: £6.6 million

Already, £16.2 million of net receipts—almost 20% of forecast cashflow—is secured through completed transactions, lowering financial risk.

Mr Hudson says that “as is to be expected there are minimal commercial changes to the overall position of the business plan”.

He says the key points to note are:

The Soham Eastern Gateway site is now forecast to be sold in September 2026, as opposed to the plan presented last year which had this marked as the early part of 2026. This is due to delays in completing planning.

The final phase 6 of the master developer site at Burwell will be marketed for sale once planning consent has been achieved, which is now expected to be in May 2026

Disposal of the phase 4 site at Burwell will now be delayed to late 2027, to allow potential for opportunity to capture added value.

The Boreham strategic land site has been reintroduced to the plan following changes to National Planning Policy Framework, issued in December 2025.

Risks and mitigation

Potential challenges include:

- Soham sale delay: Judicial review could postpone sale beyond November 2026.

- Offer values below forecast: Weak housing sentiment may delay Soham sale.

- Lower strategic land values: Could impact promotion fees.

- Eddeva Park construction delays: Residential sales may be postponed.

Opportunities include:

- Boreham could outperform conservative estimates due to rail-access NPPF policy.

- Eddeva Park and Kendal Court sales may exceed projections.

- Deferring Burwell phase 4 could secure extra value post self-build restriction.

Scenario planning shows outcomes from +£4.36 million (all opportunities realised) to -£4.10 million (all risks hit), with a neutral balanced outcome.

East of England housing market context

House prices rose 1.6–1.8% in 2025, slightly below forecasts of 2%. Average property prices are £338,000–£388,000, presenting affordability challenges.

UK housebuilding and land development is expected to grow cautiously from 2026–2028, exceeding 4% per year over five years, but only 2% in 2026, highlighting the importance of strategic project timing and risk management.

Cashflow ahead of budget but profitability hits a snag

The report to the committee adds: “The plan is ahead of budget in terms of cashflow, albeit slightly behind in profitability, due to the delay to Soham Eastern Gateway receipts.”

Key takeaways

- £82m returned since 2017: Supporting council services and ambitions.

- Loans on track: £59.9 million principal and £22.3 million interest due for repayment by 2030.

- Strong cashflow: Positive £80 million projected.

- Secured pipeline: £16.2 million net receipts already confirmed.

- Robust governance: Internal controls and reporting strengthened.

Conclusion

Mr Hudson says This Land’s business plan “sets out a strong cashflow position with repayment by 2030 enabling scope to manage delays and thus cash without further support from the council”.

Confidential appendices “draw out some risks and opportunities for this sub-committee to be aware and to monitor going forward, but broadly the plan is supported as deliverable and meeting the council’s as well as the company’s strategic goals”.