Cash-strapped Peterborough City Council is nursing a multi-million-pound loss after loaning £23 million nine years ago to a company to install rooftop solar panels on homes across the city. The extent of the losses are not fully known – although council accounts show that £2.6m has been written off.

CambsNews can reveal that the community interest company which was loaned the cash by Peterborough City Council has finally been dissolved.

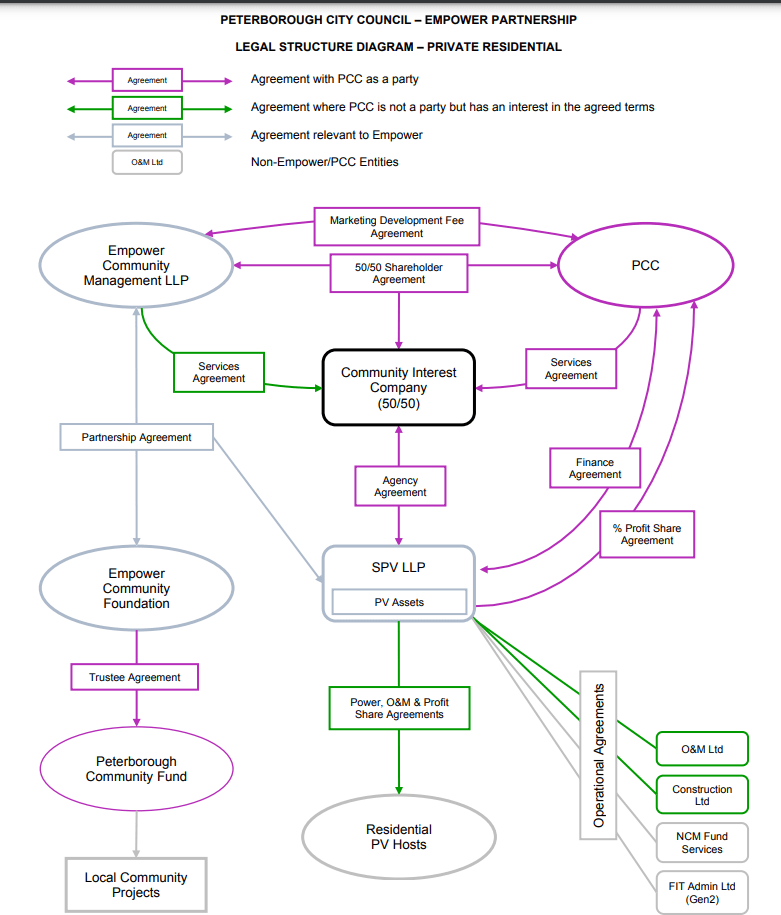

Much of what has happened since the council approved a partnership with Empower Community Management LLP (ECS Peterborough 1 LLP) in December 2014 – touted as the first scheme of its kind in the country – has been shielded from public gaze.

But the facts are becoming clearer.

And CambsNews has tried to understand and to explain its failure.

By November 2021, Peterborough City Council, with little chance of a financial return on the loan, ended up buying 7,700 solar installations across England from the administrators of the company following its insolvency.

Unlike entrepreneur Victor Kiam, the man who said he liked Remington razors so much that he bought the company, Peterborough City Council felt they had no option other than to buy the company.

Only 400 installations were carried out in Peterborough – and some of these through a “financing agreement” with ECS Peterborough 1 LLP in late 2015 to support the roll out of solar PV installation owned by Axiom Housing Association Limited property portfolio.

Ironically, a Cabinet decision in December 2014 which sanctioned the loan emphasised that partnership “would, as its primary purpose, deliver the installation of solar PVs on residential properties in the city and deliver a community benefit scheme to Peterborough”.

Then council leader Marco Cereste also felt Peterborough was onto a winner.

“The partnership with Empower Community could potentially offer every residential home owner in the city the chance to benefit financially and environmentally from the benefits of solar energy,” he said.

Cabinet also approved additional capital financing to ECS Peterborough 1 LLP up to the value of £1.5m and delegated approval to the corporate director, resources to provide further funding of up to £1m if the additional funding of £1.5m “is successfully utilised prior to the Feed in Tariff cut-off date of 31 December 2015”.

Today Peterborough City Council owns all the assets of ECS Peterborough, which came about through what is termed a pre-packaged sale of the business and assets.

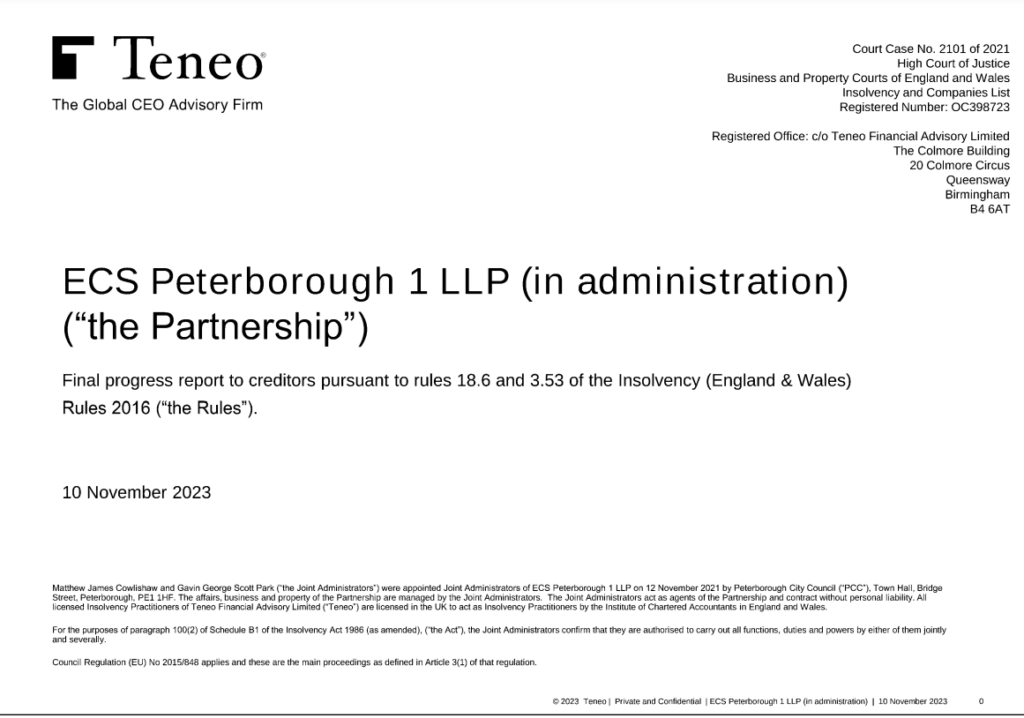

Since 2021 administrators – Teneo – have put the finishing touches to the insolvency before announcing a few weeks ago that Companies House could finally be informed of the company’s dissolution.

Teneo says the amount of the loan from Peterborough City Council totalled £23.4million at the time of their appointment.

“This included fixed charges over the solar panel equipment, credit bank balances and key contracts as well as a floating charge over all assets not captured by the fixed charge, “says Teneo.

What is fascinating in their concluding summary is that Peterborough City Council “reduced its claim by £20.4million as consideration for the partnership’s business and assets sold as part of the transaction.

“Peterborough City Council also recovered cash at bank of £440,582,” although the council only received £197,701 since the rest has been used to pay administration and insolvency costs, which the city council agreed.

All of which means the council is facing a “residual shortfall” of around £2.5million but that is without other costs which may arise.

A clue as to what value Peterborough City Council can place on the assets is within the Teneo report first published in November 2021.

It says under the heading “transaction justification” that the pre-pack sale to the city council followed an assessment that “there was no realistic prospect of an independent party paying sufficient consideration for the business and assets to repay Peterborough City Council in full, which was required before funds may become available for any other class of creditors”.

Key assets were subject to fixed charges in favour of the council.

The assessment also showed that an independent valuation of the business as at March 31, 2020, instructed by the city council, showed a “range of valuations significantly less than the transaction consideration”.

At October 31, 2021, the book value of the assets were valued at just £16.14million.

But Teneo also reported that “an independent valuation of the assets by Hilco Valuation Services on an ex-situ basis (the estimated amount for which an asset or liability should exchange) concluded that they had no net realisable value due to the costs that would incurred in respect of dismantling storage and transport in relation to the assets”.

The variation in value of the assets and that of the business as a whole can be explained by the fact that income from FiT and what the council calls “deemed export income from the generation of power by the rooftop installations”.

In short, Peterborough City Council moved overnight from providing a short-term loan to ECS Peterborough but ended up owning it – and today contracting out day to day management to Baya, described by the council as “assets manager”. Baya provides customer services, manages contractors and commercial information

“The revenue from the FiT income comes into the council’s accounts,” a city council spokesperson explained.

“This has been received by the council from when we bought the assets on 11 November 2021.

“The incomes in is reflected both in our annual accounts and monthly budget control reports. However, it is not itemised separately but is included within ‘fees, charges and other service incomes’”.

Which means, of course, working out profit (loss) on the investment is obscurely masked.

The city council explained to CambsNews that the variations in valuing the company was because it was “an open market value from a market long term financier. The value to the council as asset owner was higher as illustrated in the valuation model produced by Deloitte at the time.

“Note the value is derived from the Government FiT grant”. The Feed-in Tariffs (FiT) scheme was designed by government to promote the uptake of renewable and low-carbon electricity generation.

On reflection it would seem Empower very quickly realised it had bitten off more than it could chew.

It looked at its debt and recognised it would not be possible for full repayment of the city council’s loan over the economic lifetime of the assets, even at a reduced interest rate as low as 2.1 per cent.

Although they had secured tentative agreement for a refinancing package in 2018 of £17.5million by 2021 this had fallen to just £11.25million.

The council spokesperson said the £11.25m valuation relates to a specific offer of refinancing by one bank – “who made the lower offer when a long-term funder withdrew its offer of a full refinance because of the conditions in spring 2021 due to Covid.

“This bank was only offering primary debt; the mezzanine finance (Editor’s note: This is a hybrid of debt and equity financing that gives the lender the right to convert the debt to an equity interest in the company in case of default) would have been provided by another entity. The offers also reflect the very different interest rates available for long term projects at the time”.

Teneo says the city council would not support any further attempts as re-financing “on the basis that previous exercises have not yielded better outcomes”.

Peterborough City Council, it could be argued, has been fallen short of explaining fully to the public its relationship with ECC Peterborough.

In November 2021, when the council announced it had bought 7,700 solar installations across England “from a company called ECS Peterborough 1 LLP (ECSP1)” it did not disclose the city council was its principal investor and secured creditor.

The city council simply said that “the panels were purchased from the administrators of the company following its insolvency”.

The council spokesperson, asked if there were any physical assets in their possession following the purchase, said that apart from the rooftop installations “there are some spare panels and these are being held to replace panels if they become damaged, so we can keep receiving the FIT income”.

At around the same time, Teneo was compiling its first administrators’ report which concluded that the ‘secured creditor’ (i.e. the city council) would not be repaid in full. HM Revenue and Customs was unlikely to be paid anything it might be owed, and should any unsecured creditors be found they, too, would not be paid.

Teneo explained the background.

ECS Partnership was set up in 2015 to develop a portfolio of residential solar rooftop insulations whose income would be derived through the Government’s Feed in Tariff (FiT) scheme.

It was intended that the house occupier – be it a social housing tenant or homeowner -received free electricity generated by the solar installation.

Under the FiT scheme a pre-set, indexed amount of kWh of electricity generated by the solar installation would be paid to the partnership in the form of what is known as Generation Tariff (100 per cent of generation) and the Export Tariff (a deemed 50 per cent of generation).

The idea was that after the FiT scheme period had ended 20 years from installation and generally expected to be between 2032 and 2037, ownership of the solar assets would be transferred to the owner/occupier.

Teneo says the partnership had a combined installation and acquisitions portfolio of about 7.700 solar installations with a generation capacity of c20 MWp in eight locations across England.

However, it came to an abrupt end in 2017, says Teneo, and no new solar installations were completed after that date following the Government decision to substantially reduce the tariffs and therefore remove incentives.

Teneo makes the point that the £23million loan from the city council in 2015 was intended “to be for a short period” since the partnership had expected to be able to refinance the loan.

The city council’s original loan was short term, and according to the council “delivered a return and contributed to the council’s budget. The original agreement had been due to end in 2017, however this was extended and in September 2020 extended to a long-term loan.

“Despite assurances that this arrangement was achievable, Empower advised in 2021 that payment couldn’t be made and were granted six weeks to find funding and make the payment,” says a city council report.

It did not happen, and insolvency advisors were then appointed by the council

By the time of Teneo’s appointment there was no alternative lender in sight.

Teneo explains the refinancing efforts throughout the four-year period to November 21 but says “unfortunately, despite repeated efforts to resolve the situation, the partnership was ultimately unable to refinance/restructure the business”.

Peterborough City Council, it says, having “explored the various options” elected to take ownership of the partnership’s business through a pre-pack administration process. The court order to appoint administrators was granted to the city council on November 12, 2021.

In November 2021 the city council, having announced its purchase of the partnership’s assets, also said it now “manages the solar panel assets in place for existing customers while aiming to generate as much electricity as possible.

“Along with several specialist companies, the council seeks to provide customers with the best service and value”.

Customers were advised they might hear from the city council or one of its partners. These were listed as:

As part of this, you may hear from us or one of our partners:

- Peterborough Limited (wholly owned subsidiary of Peterborough City Council) – provides contract and asset management services

- BayWa – provides customer services, manages contractors and commercial information

- BI Electrical and the Green View Group – contractors completing maintenance requirements, under the instruction of BayWa and Peterborough Limited

But the council statement also added: “Please note we are not taking on any new customers.”

It was all a far from the optimism of 2014 when the city council trumpeted it was “set to spearhead solar scheme for residential homeowners”.

It described a “pioneering new scheme” to offer solar panels on roofs across Peterborough.

And it promised that under the scheme, property owners would benefit from in the region of £200 worth of free energy each year generated by the solar panels and a one-off payment of £100 every five years for their participation in the scheme. There would be no cost to the owner of the property whatsoever.

CambsNews has also inquired about a community fund promised by the city council that would use a percentage of the money the scheme generates.

The council had expected that with a take-up of 1,500 properties, the fund could total around £1 million over the 20 years of the scheme.

In addition, the council was also expected to generate in the region of £1million during the same period.

Cllr Marco Cereste was council leader at the time and cabinet member for growth, strategic planning, housing, economic development, and business engagement.

He said at the time that “the partnership that we want to enter into with Empower Community is a win/win for our residents, the council, and the wider city.

“It also bolsters our ever-growing environmental credentials by reducing the carbon footprint of our residents and the city as a whole.

“Currently, having solar panels on residential properties tends to be restricted to those who can afford them, people who are approached by companies who install solar panels for free and those who live in social housing.

“The partnership with Empower Community could potentially offer every residential home owner in the city the chance to benefit financially and environmentally from the benefits of solar energy.

“In addition, there would be a benefit for the wider community through the community fund, and the money the council will generate over the life of the scheme which could be used to protect frontline services.

“As is well documented, our grant from government has been reduced by £40 million since 2010 and this trend sees no sign of slowing pace. We have got to look at new and innovative ways of working to attract investment, through schemes such as this, so that we can continue to provide the services that our residents need and expect from us.”

The proposal was for the scheme to be trialled in the areas of the city which have formed part of the Green Deal Community Fund – Bourges Boulevard, Clarence Road, Cromwell Road, Crown Street, Dogsthorpe Road, Eastfield Road, Gladstone Street, Harris Street, Lincoln Road, and St Paul’s Road.

If the scheme is successful in these areas, then it will be rolled out to the remainder of the city.

Council minutes from 2014, where the scheme was endorsed, hailed “the positive community aspects that the scheme would bring, particularly in terms of those individuals who were in fuel poverty in the city and also in terms of environmental issues”.

Councillors were also told “the scheme had been endorsed by local MPs and the scheme highlighted Peterborough’s innovativeness”.

And the financial benefit to the 1500 people, who would benefit from the first phase, would equate to around £6m over the period of the scheme.

The council concluded: “Going forward, the scheme could be worth in the region of £50-£60million city wide and for residents; and the various energy saving schemes that the Council was rolling out, could save each individual person that took part in the region of £640 to £700 per annum”

Councillors were told if they did nothing “the council would lose the significant opportunities devised by the scheme”.

Peterborough City maintains “the value of the assets derive from the FiT and deemed export income received from the generation of power by the rooftop installations.

“To receive this income the panels must remain in situ as part of the installation accreditation received when they were installed.

“If the panels are removed, the FIT income ceases, hence their realisable value is negligible if they are removed. However, they remain in situ, generating income”.

The council spokesperson added: “The value of the income is commercially sensitive and will not be disclosed.”

The spokesperson said interest was received on the loan to Empower “which was above its cost of borrowing. The council did write down the value of the loan which has been fully documented in the statement of accounts.

“Over the lifetime of the loan the council will not have lost money.

“The council continues to receive FiT income for the solar panels. That income does not service the loan specifically but rather funds council services”.

The £2.6m loss “was written off fully in 2021/22.”

So how much is the city council receiving annually in FiT income.

“The value of the income is commercially sensitive and will not be disclosed,” the spokesperson added.

EY, the council’s auditors, as part of their review of 2019/2020, probed the loan to Empower and the security the council had over “underlying assets”.

A council report says this work was finalised in March 2021 “and EY informed the council they were not minded to challenge the accounting treatment in the 2019/2020 financial statements, although note was to be made over the aggressive nature of the proposed model”.

Their later revaluation “resulted in an impairment of the loan in the accounts to £20.4m. This revaluation has been calculated on the net present value of the cash flow forecasts and is not necessarily a reflection of the assets once the period of the administration has ended”.